An underpayment penalty is what a United States tax payer may receive if he or she did not pay all of the previous year's income tax. The underpayment penalty is a certain amount of interest, ranging from 4 to 10 percent, added to the amount owed to the Internal Revenue Service (IRS). A penalty can often be avoided if the individual quickly pays 100 percent of the last year's taxes, or 90 percent of the current year’s taxes. A tax payer in danger of an underpayment penalty will receive a 90-day letter informing the individual that they have 90 days to respond before a penalty is assessed. Once an underpayment penalty is enacted, it remains in place until the full amount of taxes owed is paid.

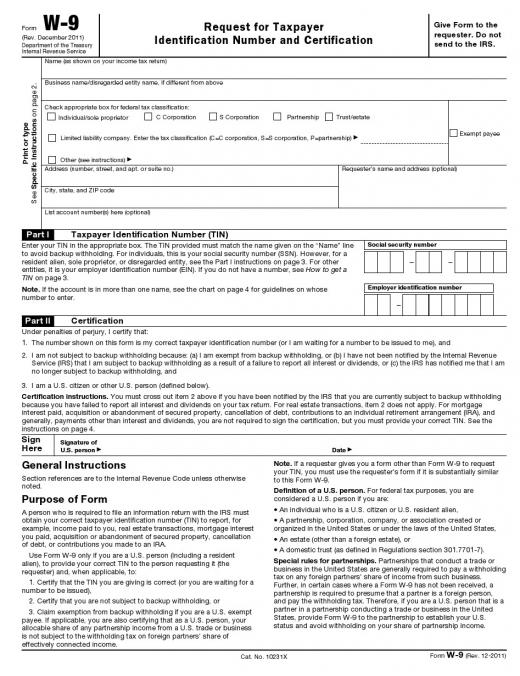

Typically, income tax is withheld throughout the year, automatically taken from paychecks and salaries. Some income, however, is not automatically withheld, leaving it up to the taxpayer to pay taxes owed. Freelance and contract employees receive such income, which is filed under a W-9 form instead of the standard W-2. Since taxes in the U.S. are meant to be paid year-round, W-9 income tax may be paid on a quarterly basis. If, however, it is not paid quarterly, it may also be paid in a lump sum at the end of the year.

Tax payers who find themselves in crisis of underpayment can take advantage of the annualized income installment method. This method calculates an installment payment by taking into account the tax payer's income minus deductions. This has the possibility to either eliminate or at least reduce the underpayment penalty, and is a good option for confused tax payers who aren't used to or didn't expect to earn a significant amount of untaxed income. As calculations can be a bit overwhelming for the average tax payer, it's generally wise to consult a tax expert in this situation.

Not all who earn untaxed income are subject to an underpayment penalty. If 100 percent of the previous year's taxes, or 90 percent of the current year's taxes are paid, a penalty won't go into effect. Also, if the amount of untaxed income earned was less than $1,000 US Dollars—after all credits and withholdings are subtracted—the IRS won't bother with underpayment penalties.

Underpayment penalties can be waived if extenuating circumstances caused the tax payer to pay less than owed. If the underpayment was a result of an unusual circumstance, such as a disaster or casualty, then the penalty will not be enacted. Retirees over the age of 62, and those who became disabled during the relevant tax year may also be exempt from penalty.